Learn with Us

We use cookies to enhance your experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more information, please review our Cookie Policy

Cheques became popular as a non-cash payment instrument with the development of banking systems in the country. Although cheques were used as early as 1820, the first mention of a clearing process for cheques in Sri Lanka was in 1885 by the Colombo branches of the Madras Bank and the Imperial Bank of India.

On 29 August 1950, after the Central Bank was established, it took over clearing duties from the Colombo branch of the Imperial Bank of India, which had previously handled them. At that time, the manual clearing process required all banks to meet at the Central Bank to physically exchange cheques. This involved a main clearing session in the morning, where banks exchanged cheques for collection of funds, and a settlement clearing session at noon, where invalid cheques were returned. The Central Bank manually computed and settled the net balances, informing banks of their account balances by 8:00 a.m. the next business day. Despite being functional, this manual process often led to errors and delays due to the challenges of manual balancing and accounting.

As cheque volumes grew, automating the clearing process became necessary. This led to the establishment of the Sri Lanka Automated Cheque Clearing House (SLACH) on 2nd March 1988 as a subdivision of the Central Bank's Data Processing Department

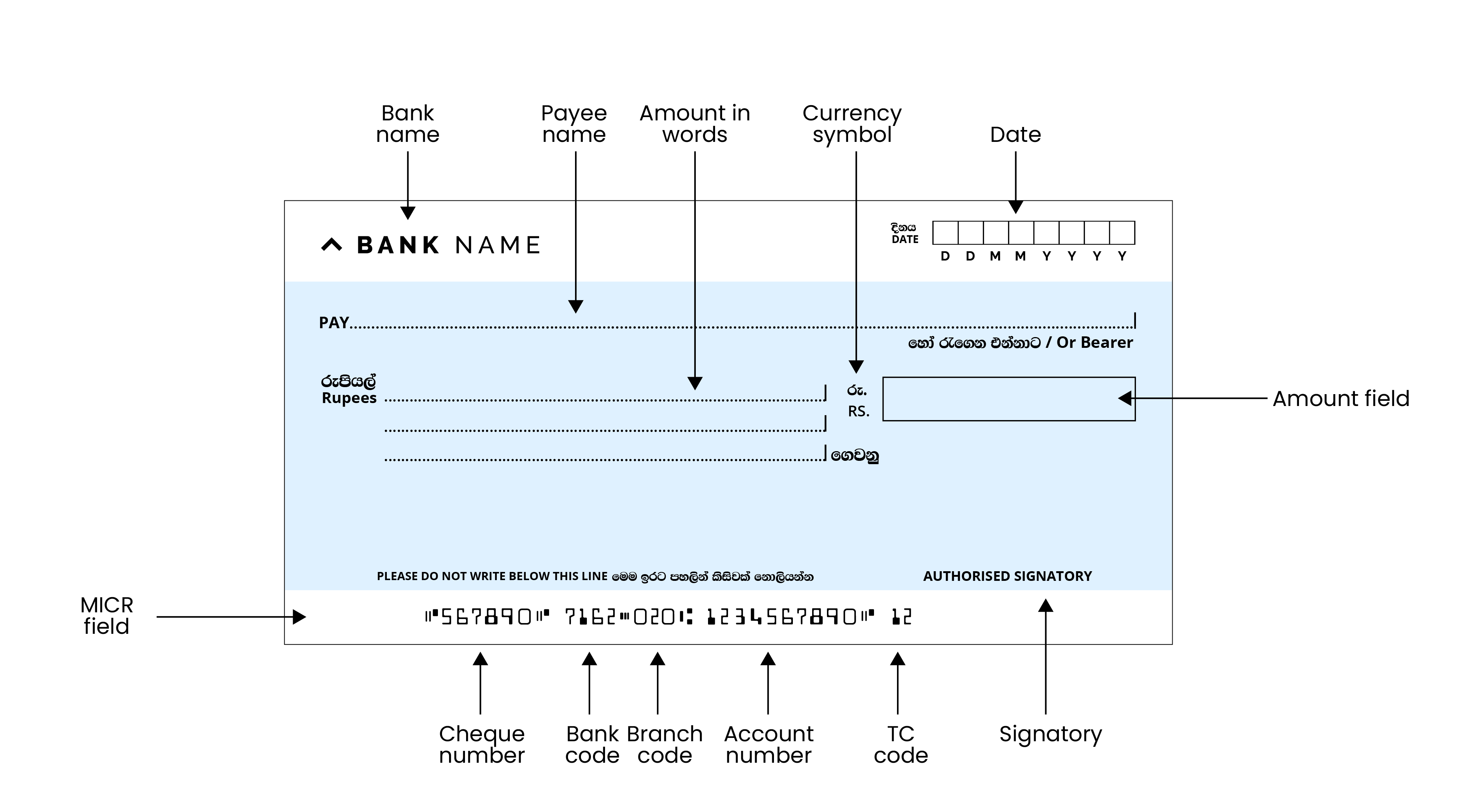

Automation required changes to cheque design, including adding a Magnetic Ink Character Recognition (MICR) band to encode key details like the paying bank, cheque number, and value. Cheques were then electronically sorted by reader/sorter machines according to recipient bank order, speeding up processing.

However, since physical cheques still had to be transported to SLACH, maintaining consistent processing times nationwide was challenging. To reduce travel time, the Central Bank set up regional clearing centers in Matara, Anuradhapura, and Matale, eliminating the need for cheques from these areas to be sent to Colombo. Additionally, some banks created informal regional clearing arrangements to expedite the process in specific regions.

Recognizing the efficiency and cost-effectiveness of independent clearing houses in other countries, the Central Bank decided to transfer its cheque clearing functions to a newly established company. Thus, LankaClear (Pvt) Ltd was incorporated under the Companies Act on 08th February 2002, with both commercial banks and the Central Bank as shareholders. Since its inception, LankaClear has operated smoothly and consistently grown, proving its effectiveness in managing the nation's cheque clearing processes.

In 2022, LankaClear changed its name to LankaPay (Private) Limited to better reflect its range of services. LankaPay is now recognized as one of the top Public Private Partnerships (PPPs) in the region.

In 2005, the Central Bank, along with LankaPay (Private) Limited, began planning the Cheque Imaging and Truncation System (CITS) to speed up the cheque realization process, which then took 1 to 10 days depending on the banks' locations. With CITS, the physical cheque is truncated at the collecting bank, and only its image is sent to LankaPay for sorting. To support this, LankaPay set up 10 regional centers for banks to hand over cheques for imaging until they could develop their own image-capturing capabilities.

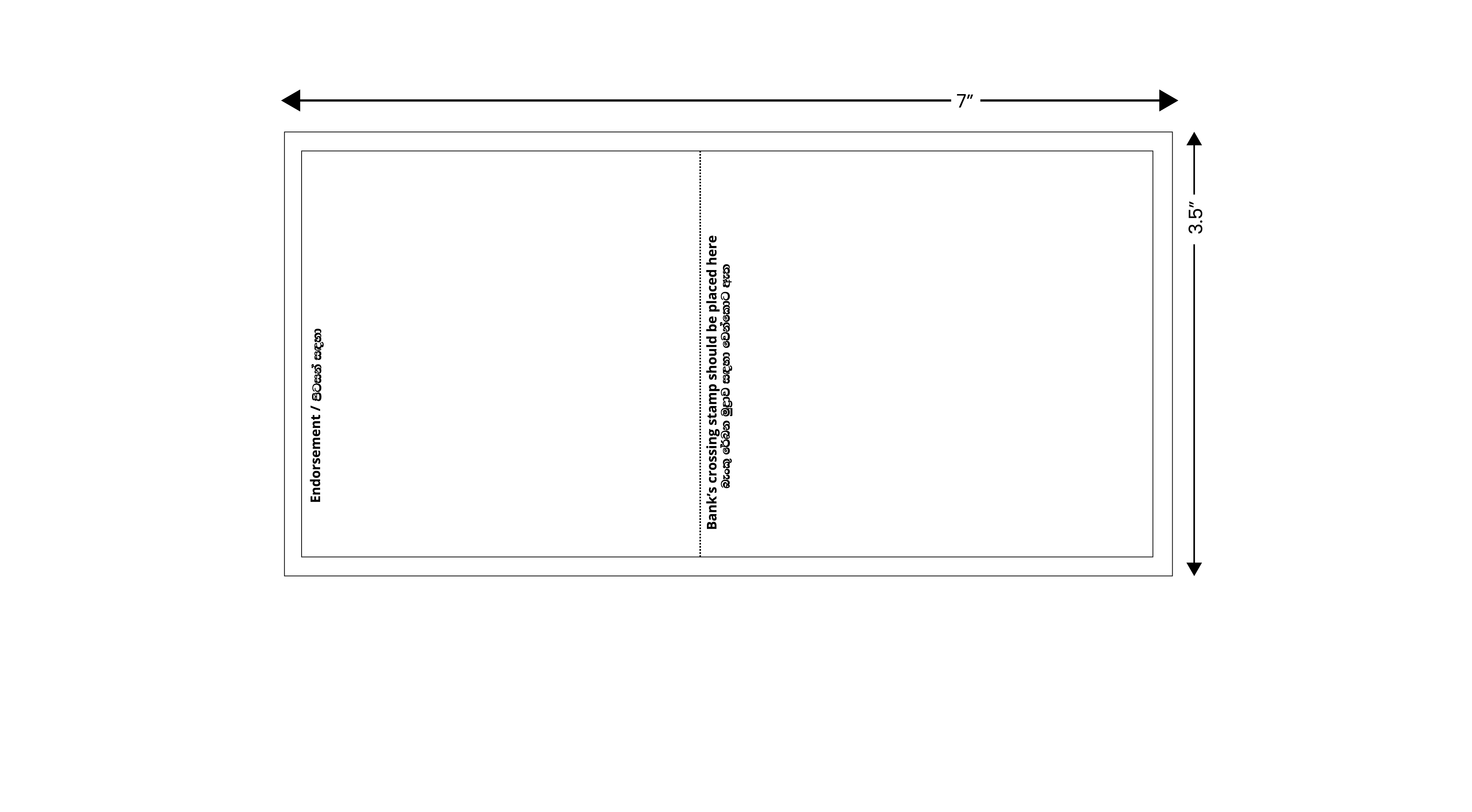

The cheque design was standardized to ensure legible images, as signature verification would now be done through images rather than physical cheques. The images were transmitted via dedicated communication lines to LankaPay, where they were sorted and sent to the paying bank. The main benefit of CITS was the ability to clear cheques island-wide within T+1 (the day of deposit plus one business day). The CITS system was successfully implemented on 11th May 2006.

Since then, all commercial banks have upgraded their technology, linking most branches to head office systems through core banking packages, reducing the need for LankaPay's regional offices. Consequently, these offices were closed on 30th July 2010, and banks began submitting images to LankaPay using CD-ROMs. On 1st October 2017, LankaPay further streamlined the process by introducing direct connectivity for all presenting banks, enabling electronic submission of cheque images without physical transfers.

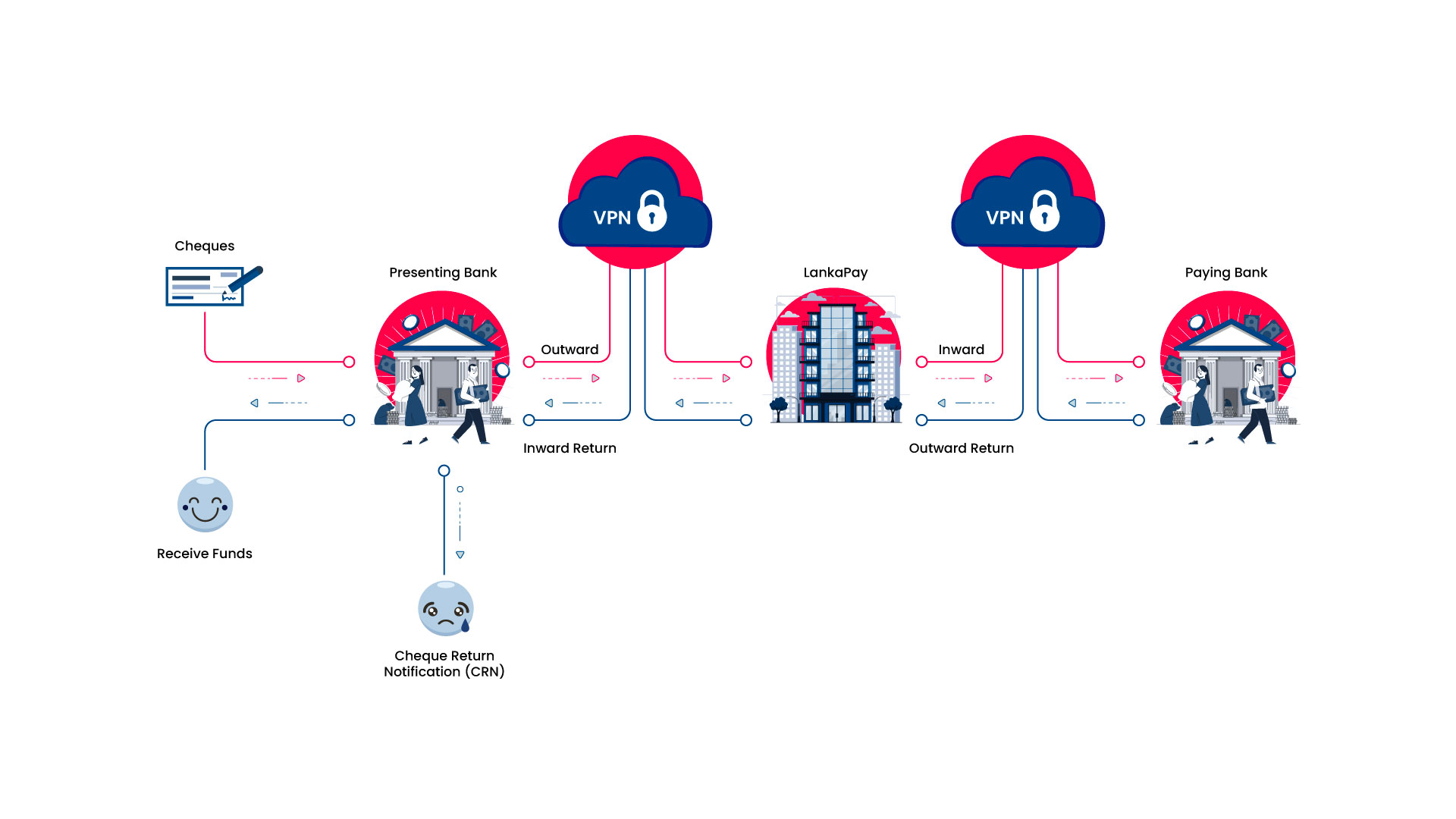

The cheque clearing process involves several steps from the moment you deposit a cheque at your collecting bank until you receive the funds. Here's a breakdown of the typical cheque clearing process:

You deposit the cheque into your bank account by either handing it over at a bank branch or using a cheque deposit machine that accepts cheque deposits.

At the collecting bank, the electronic images are captured and sent along with the relevant Magnetic ink Character Recognition (MICR) information to a clearing house

Note - The physical cheque is truncated or retained at the collecting bank. Only a digital image of the cheque is sent for further processing.

Clearing house sorts the cheques received from various collecting banks and make available to download sorted electronic images and MICR information to paying bank.

The signatures and other details on the cheque are verified against the paying bank's records to take the ‘Pay’ or ‘No-Pay’ decision.

Paying bank will sort the MICR information of the cheques that can be paid from the cheques that can’t be paid and transmit that information to clearing decision.

Clearing house will sort the return instructions form paying bank and transmit the MICR information to collecting bank to returned cheques. If there is no return instruction, paying bank will credit your account with the cheque amount, making it available for withdrawal or other transactions.

If the cheque is returned you will receive a cheque return notification (CRN), with the instructions to proceed with next steps

Earliest known cheque clearing practice in Sri Lanka

First mentioning of a clearing process between Colombo branches of the Madras Bank and the Imperial Bank of India

Central Bank took over the clearing process from Colombo branch of the Imperial Bank of India

Incorporated Sri Lanka Automated Cheque Clearing House (SLACH)

Incorporated LankaClear (Pvt) Ltd as the cheque clearing house

Implemented Cheque Imaging and Truncation System (CITS) while being the 1st in South Asia and 2nd in the world to enable nationwide cheque clearance on T+1 basis

Closed regional centers and commenced cheque image submission via CDs for clearing

Introduced the direct connectivity mode for all banks for CITS settlement clearing with digital certificates for greater security and extended cheque submission time to 7:00 p.m.

Enable direct connectivity for online cheque image submission for clearing

A cheque is a written order given to the bank by the current account holder to pay a certain amount of money to the person whose name is written on the cheque or to the bearer of the cheque.

Who are the main parties involved in a cheque

Drawer : Account holder

Drawee : The commercial bank where the account is maintained

Payee : The person named on the cheque or the person entitled to receive the stated amount on it

This is a cheque where printed notation "or bearer" has not been cancelled. While, in the absence of an endorsement this cheque can be assigned to another person by merely handling it over, to great extent it is similar to carrying out a transaction using currency notes

This is a cheque where "or Bearer" has been struck off and in its place "order:” has been mentioned. When a cheque like this is being assigned to another person it is necessary to be endorsed. There is a higher saftety level in an "order" cheque over a "bearer' cheque

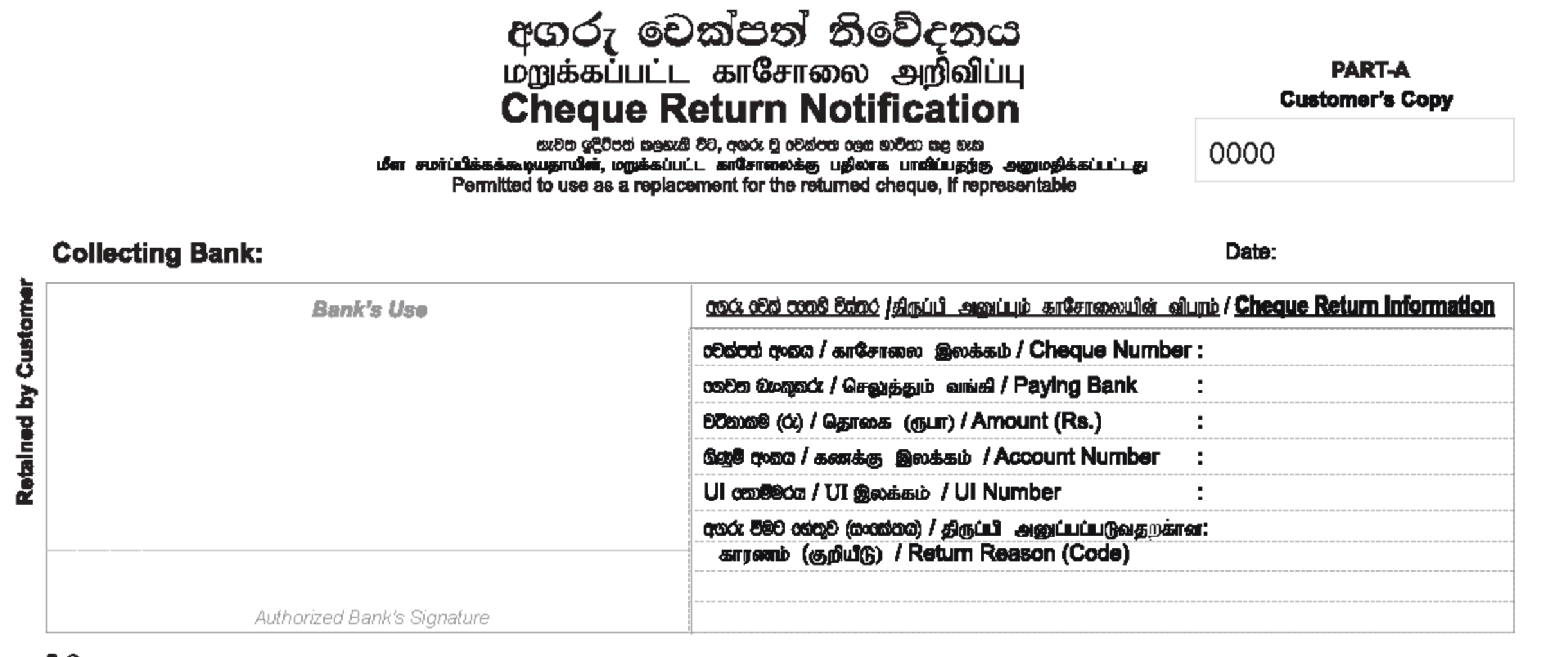

Under the CITS cheques are not physically presented to the drawee bank. Hence, it is not possible to write the cheque return remark on the cheque. If a cheque cannot be paid for whatever reason the paying bank has to select and activate the appropriate cheque return code, and a Cheque Return Notification (CRN) will be provided to the customer.

The Payment and Settlement Systems Act No. 28 of 2005 lays down the procedure in respect of the payment of cheques electronically presented. Section 34 (1) of the act states that the bank to whom the holder delivered a cheque for collection is permitted to issue to the holder Cheque Return Notification.

The Cheque Return Notification format has been designed to conform to all requirements set out by the CBSL. A collecting bank which has been authorized to issue CRNs shall do so in accordance with specifications given by LankaPay.

Part A is the customer’s copy and should be retained by the customer. It contains information of cheque number, paying bank, amount, account umber UI Number and Return Reason code.

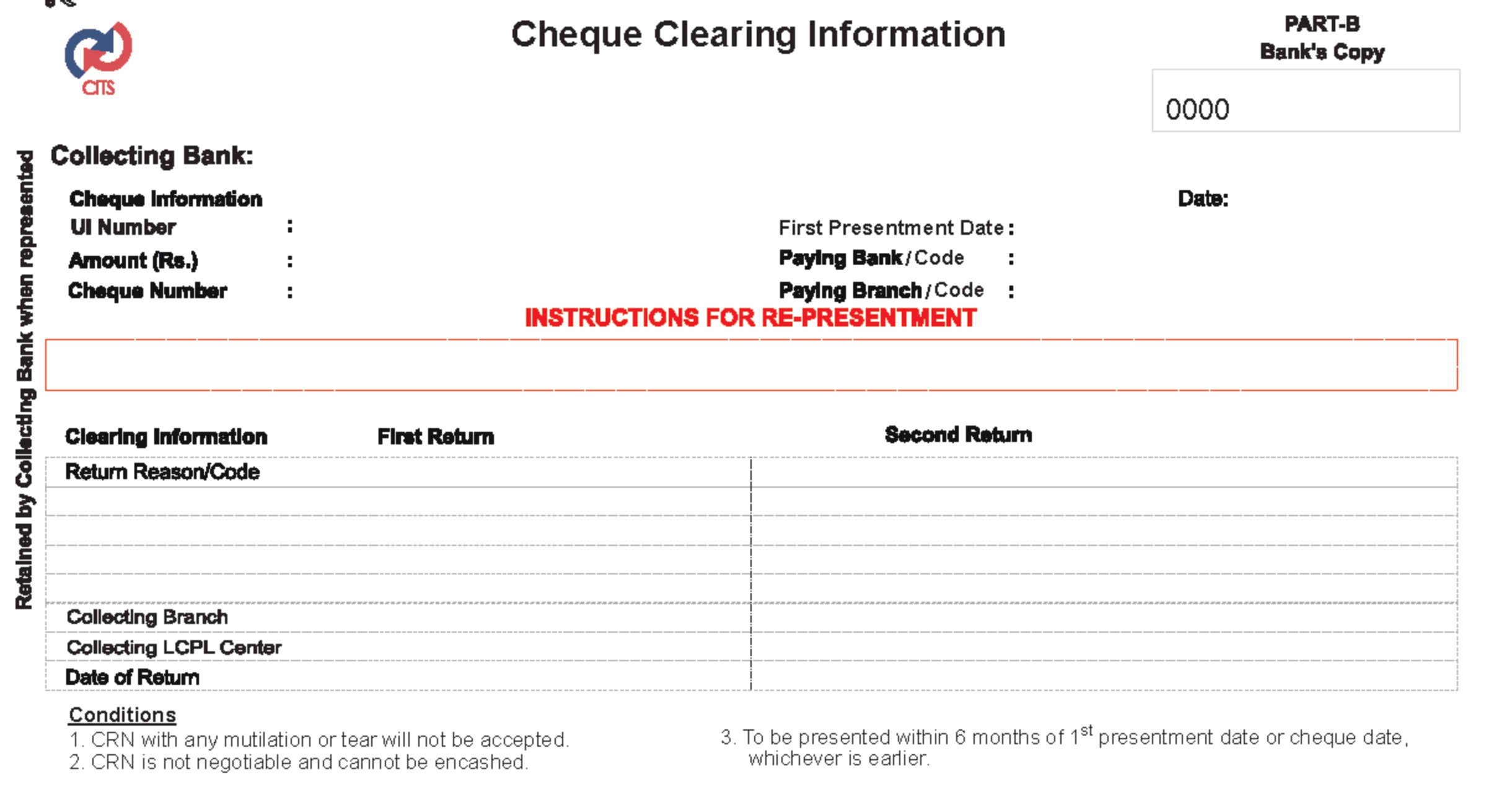

Part B contain the clearing information and it shall serve as the bank’s copy. Instructions for re-presentment and conditions for re-presentment are clearly stated.

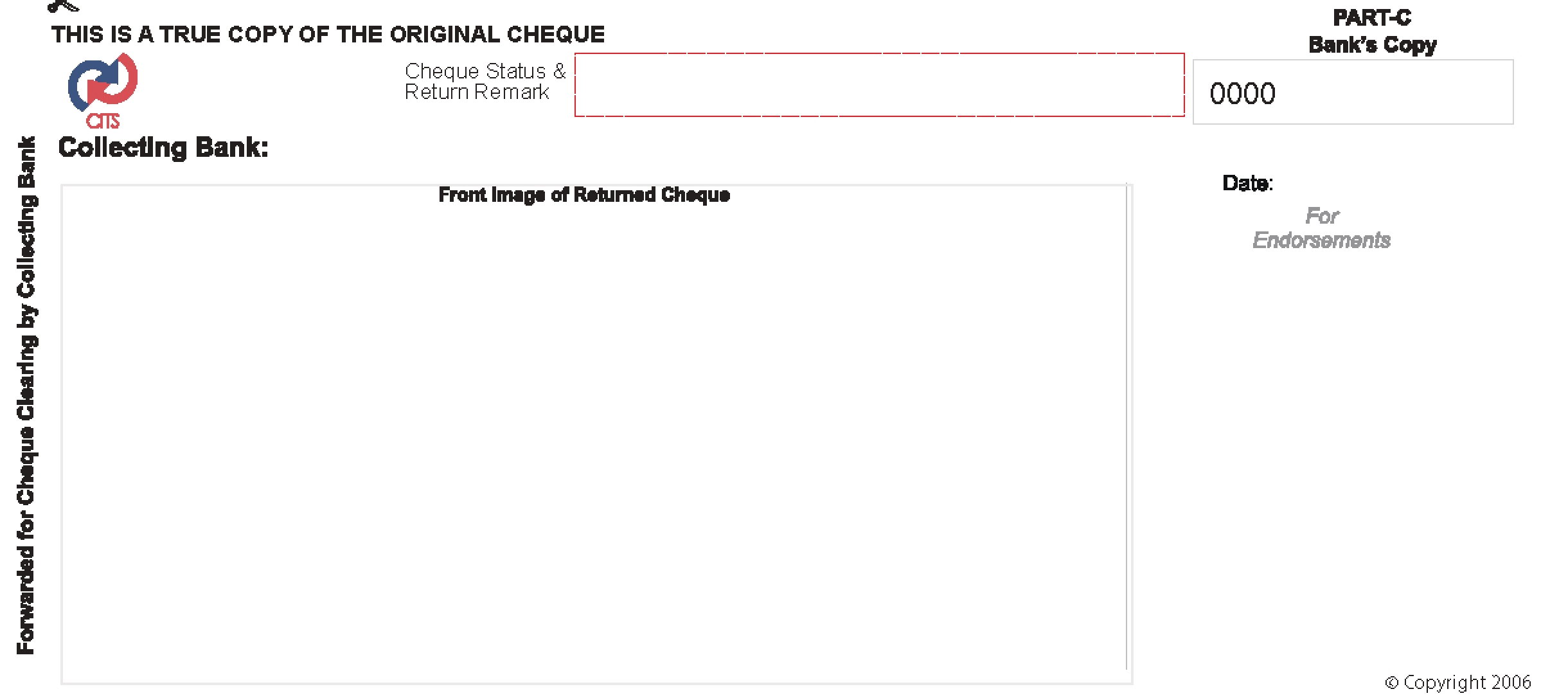

Part C shall be deemed to be the cheque to which it relates and therefore the front of this part shall carry a true, complete, and accurate image of the face of the original cheque.

If a cheque is returned due to a return remark, which falls into said category the presenting bank shall be in a position to represent the CRN via transmission of an electronic image.

If a cheque is returned due to a return remark which falls into category 2 the presenting bank will not be able to represent the CRN.

Sign up for LankaPay's newsletter to stay informed about the latest trends, regulations, and product details delivered straight to your email.